Adjusting sales tax in quickbooks for mac

If not, all your pre-new rate invoices will not retain the old rate description. Thank you for adding a reply and sharing you thoughts, gclsi. However, we also have the option to deactivate the old sales tax item with the old rate and create a new one.

How we calculate collected sales tax

For the detailed process on how to edit the sales tax rate, refer to the steps given above. On the other hand, to inactivate the old sales tax item and rate:. Set up sales tax in QuickBooks Desktop. Our doors are always open here in the Community page. Feel free to click the Reply button if you have any other sales tax questions.

How to Enter Sales Tax Collected in QuickBooks

Have a good day! This website uses cookies. By browsing this website, you consent to the use of cookies.

Learn more. United States United Kingdom. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Showing results for.

How to Adjust Sales Tax in QuickBooks

What is the best way to document this in QBO? Is there a way to make multiple payment recordings in QBO for the state each month that would document each of these? I keep trying to do this. The amount that QB is showing is just pennies more then what the state is calculating.

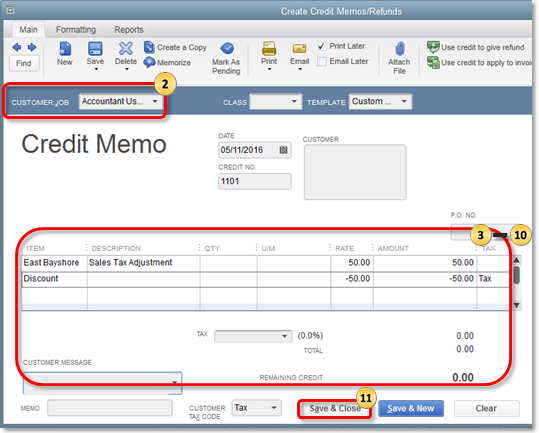

Allow me to step in and provide some information about making sales tax adjustment in QuickBooks Desktop.

Recent Posts

It's good to see you here, tjmand4,. Here's a great resource that you can check on for more detailed steps: Manage Sales Tax Payment. However, if you're using the Automated Sales Tax feature, here's how to make Sales tax adjustment:. You can check out this article fro more detailed steps: Set up and use Automated Sales Tax. If there's anything else you need help with in adjusting Sales tax, please feel free to reach back out.

Have a great day! This website uses cookies. By browsing this website, you consent to the use of cookies. Learn more. United States United Kingdom. Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type. Showing results for.

- rsa securid software token for mac?

- Adjusting Sales Tax in QuickBooks for Mac?

- best photo recovery tool mac?

- Finding and Fixing Sales Tax Errors in QuickBooks for Mac?

- Process sales tax adjustment - QuickBooks Community.

- How to Fix Incorrectly Recorded Sales Tax in QuickBooks.

Search instead for. Did you mean: US QuickBooks Community: QuickBooks Desktop.

Override sales tax on transactions - QuickBooks Community

Best answer Accepted Solutions. If the amount to be paid is less than the QB collected am If the amount to be paid is less than the QB collected amount, you got a discount in other words, use an income account if the amount is higher, then use an expense account. Thanks Rustler. We are trying to figure out if in this ca We are trying to figure out if in this case since the State shows us owing a slight bit more if that expense account should be "sales tax payable" which is the standard account for paying owed sales tax, or if we should put it to an "other expense" account.

When you adjust up or down, that adjustment hits the adjustment account AND sales tax payable. Thank you!