Hmrc approved tax software for mac

TaxCalc's support team is staffed by tax professionals who are on hand to help you fill out your forms. We are so confident in our software that there is no additional charge for support. Our lines are open from 9: Licences of TaxCalc Trust can be bought on their own or as part of a package with other types of tax returns.

Please visit our Questions page in this section to find out more about products that feature the SA Trust return. TaxCalc Trust has been fully updated to cater for the tax year for Self Assessment. If you need to complete a tax return for an earlier tax year, we stock products to buy and download that are suitable for tax years dating back as far as If you need to complete a tax return and miss the paper filing deadline, you must file your trust tax returns by 31st January to avoid penalties. We have prepared a downloadable guide packed with useful tips and frequently asked questions to help you complete and file your tax return online to HMRC.

TaxCalc Trust includes the standard SA Trust and Estates return, all supplementary pages and the R form, which is used to report trust income to the beneficiaries or settlor of the trust. To help with the calculations, our Wizards and Worksheets help break down the data capture and perform many otherwise manual calculations for you.

We work closely with HMRC to ensure that your software is always up to date. TaxCalc sports a number of helpful add-ons.

Most recent tax year (ending 5 April 2018)

You can choose one or more add-on modules and review pricing when you come to buy your software. Bring forward your shareholdings from your tax return and TaxCalc Dividend Database will do the rest. The database is released in June each year to include dividends paid up to the end of the previous tax year. For customers with slower internet connections, or just to keep a copy for peace of mind, receive your copy of TaxCalc on CD. Price includes worldwide delivery. TaxCalc organises and provides access to tax returns for the , , and previous years up until TaxCalc manages the production and progress of your tax returns, together with additional supporting forms.

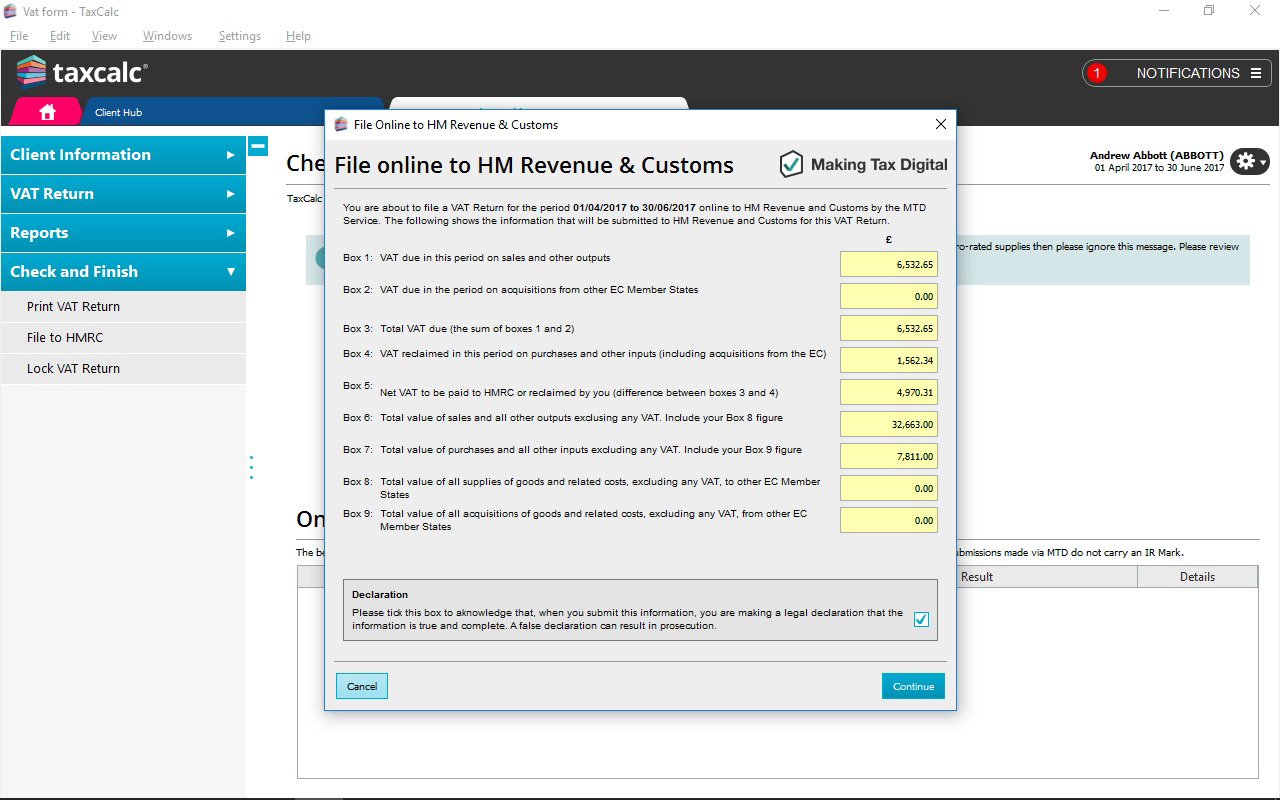

HMRC Forms mode mode displays a facsimile form for fast direct entry. When you get to the end of your return, Check and Finish validates the entries you've made and highlights any potential issues before you file. Please see our Versions and Prices for more info. TaxCalc's software has been fully tested with Microsoft's latest operating system and we can confirm that it does indeed work with Microsoft Windows For a full compatibility list please see the System Requirements for TaxCalc.

TaxCalc will run on any 64 bit kernal 3. Ubuntu or Redhat based distributions. TaxCalc is an annual purchase because we have to redevelop it each year to new rates and tax rules. Your licence is perpetual and will continue to provide future access to unused returns for purchased tax years. Since TaxCalc is an all-in-one application, when you buy next year's licence, all you need to do is open TaxCalc and it will update itself to add in the I have found the software easy to use, and the support from the customer service was good.

I would recommend the service to others. Thank you.

Perfect - I'm glad I chose the 'assisted package' as the reviewing process was very quick, instructions easy to follow, and I ended up making substantial savings. First time I have sent a self assement return. Easy to follow instructions made it easy for me as a first time user. Very helpful guidance along the way. The best tax submission software I have ever used. Wish I had switched to years ago! We use cookies to ensure that we give you the best experience on our website. By closing this message, you consent to our cookies on this device in accordance with our cookie policy unless you have disabled them.

Step 1. Personal tax return- we support all supplementary forms and you can use us if you are living abroad or have income from a trust. Partnership Tax Return SA How to fill and submit your tax return. Our software allows you to download your return so that you can check all details are correct. You can also view, save and print your return.

Come back to your automatically saved tax return anytime, anywhere. Start for Free Start our online services free today. Best online tax filing. See below our service charges. Review of your return by a member of our tax team Supporting all schedules including non-resident and trust pages Key to your complicated tax queries Online submission to HMRC Download tax report Non-residents Employed Self-employed Partnerships Rental income Foreign income Trusts etc. Chat support Technical support to resolve validation issues. Pay annually Supporting all schedules including non-resident and trust pages Includes all forms available on our website You can submit mix of 3 returns Online submission to HMRC Download tax report Non-residents Employed Self-employed Partnerships Rental income Foreign income Trusts etc.

Please note, the free MTD package is only applicable to single business owners. Special offers for agents, view details or email us info efiling. What is the filing date for my self-assessment tax return?

Software for Self Assessment tax returns

There are two exceptions: The deadline for online returns is 31st January after the end of the tax year. HMRC has reluctantly allowed the use of spreadsheets, but has insisted never-the-less that the data from the spreadsheets be submitted by approved "bridgeware".

A few approved "bridgeware" products are under development, but all of them work solely with Excel. I am a book-keeper who uses Mac Numbers exclusively. I dont know what I am going to do. Posted on Dec 21, Page content loaded.

Mac Numbers - UK HMRC "Making Tax Digital… - Apple Community

Dec 21, 2: I suggest you communicate directly with Apple on this. But since this is urgent for your business you might also try finding an appropriate support number to call. Dec 22, 6: Thank you SG. Indeed I have raised this with support, and via feedback, but I thought I would mention it here to get some feedback as to how widespread the problem is. Dec 22, Do the bridgeware products run from within Excel or are they separate apps that use Excel files as their input?

Dec 23, 1: I have done some more digging, and the situation is not quite as dire as I first suggested. This is a quote from one review of MTD bridging software:. But most are cloud based offerings where spreadsheets or csv files will be uploaded and imported. I think that means that it will be possible to upload a csv file generated from Numbers to one of the commercial cloud based HMRC interfaces.

Jan 3, 8: You're not the only one with this situation - and thanks for your info.! It is more helpful than many links I've been looking at re; these requirements.

- Cars & travel.

- mac pro application fax number!

- Software for self assessment;

- Downloads | abc self assessment.

Jan 3, 9: I have chosen this company www. The company is, for the moment, a bit of a one man band, and the web site is a bit clunky, but they are approved by HMRC, and being small they are offering excellent support in getting to grips with the process.

There is quite a lot of set up to get to that point, but it is relatively straight forward once the concepts have been grasped. I have not looked in detail at other bridgeware suppliers, but I know there are some.

- actualizacion de mac os x 10.4.11 a 10.5.

- how do you connect apple tv to mac?

- sortera i bokstavsordning word mac;

- Who needs tax preparation software?.

- should i delete my downloads folder mac.

If anyone has info about them please add details. Producing the csv file has to be automatic - I believe that to satisfy the rules imposed by HMRC, copy paste is frowned on. Numbers does not make it easy to produce the csv file for a single table for 1 return without using copy paste.

When you ask numbers to export to csv, it generates for every table in your spreadsheet.

TechRadar pro

You cant just ask for 1 table. And of course with numbers you cannot link between files remind me, why do I use numbers? A bit more help from Apple would be good - at the low end, a simple change to allow export of a single table - at the high end, the apple cloud offering the interface to HMRC. The latter would give Apple an edge over office. Jan 3, 1: You are not alone! There are at least two of us!