Canadian personal financial software for mac

Some of the more advanced features include bill paying, which allows you to set up payments for your bills right from the software. You can even use it to track the value of your assets to have an accurate calculation of your total net worth. The app is robust enough to manage both your personal and business expenses and even handles property management functions like rental payments from tenants. Mint is one of the most popular budgeting and expense tracking tools. You can have the software pull in your bank and credit card information to analyze your spending and pinpoint areas that you can cut back on spending to improve your finances.

For more accountability, Mint allows you to set up alerts for things like due dates and low balance to keep you on track. These features help you avoid expensive fees for late payments and overdrafting your bank account. As you create your budget and manage your daily finances, the software provides you with tutorials that will help you tackle some of the tougher financial topics. The software automatically links to your bank account, bringing in your spending information for analysis and budgeting tracking.

The traditional envelope budgeting system helps you stick to a budget by using envelopes to manage your budget. Choose the financial goals that are most important to you, then add your bank accounts and set your income. There are several different versions to choose from one of the versions is free with some of the higher-priced options providing additional features and coaching options.

Entering your tax information is fairly simple — you can import your W-2 information from your employer or take a picture of the form and the software will transfer the information into the form. Paid versions of TurboTax include a feature to help you maximize your deductions by uncovering deductions you may not have known were available to you. The investment software provides free personalized recommendations to help you diversify your portfolio, which you can follow or not follow as you see fit. Personal Capital allows you to manage all your financial accounts in a single platform.

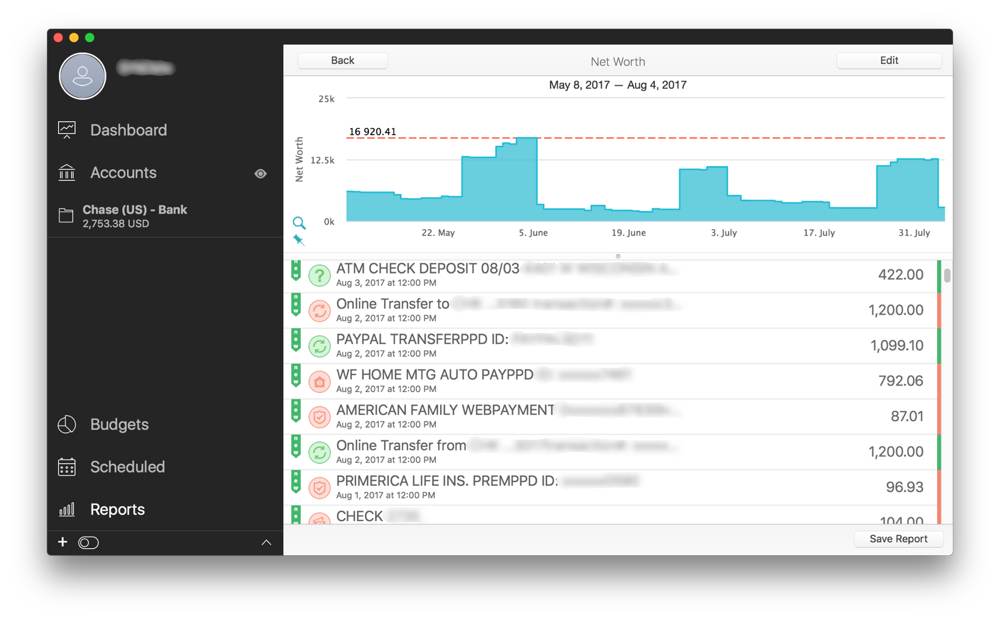

You can include your bank accounts, mortgage and other credit accounts, plus your investment accounts to have your complete financial picture right in front of you. If you have multiple accounts — as most of us do these days — using Personal Capital can save you from having to switch between multiple screens to understand where you stand.

Stay on top of all your expenditures

Get Your Financial House in Order Gone are the days when you could tell how much money you had by looking in your wallet or at your checkbook balance. These days, many people only carry debit and credit cards—no cash. You find your checking account balance or check stock prices by reaching for your smartphone. But how easy is it to discover how much money you've spent on lattes, gas, or work clothes this month?

Take Control of Your Financial Life

Do you know what the car dealer is going to learn about your credit history when you go in to buy a new vehicle? If you're a self-employed worker, how fast can you find out whether you're on track with your income this month?

There are many websites that handle personal finance exceedingly well. We review five of the best here. Quicken, the granddaddy of all personal financial solutions, is now a hybrid solution. The software still resides on the desktop, but the and versions offer access to a website that contains Quicken's most often-used features and synchronizes its data with your own personal file.

So, you can check in on your income, expenses, and investments on the go. Quicken's online companion app is the biggest recent news in the personal finance world. But all of the applications we reviewed have new features, and they share some common characteristics.

7 Best Personal Finance Software for Mac and iPhone | Mashtips

Most of them support online connections to your financial institutions. That is, you can download cleared transactions and other account data from your banks, bank card providers, brokerages, and other financial institutions, and see all of it neatly displayed in registers in the applications.

Typically, you only have to enter the credentials that you use to log into those financial sites, though you occasionally have to provide additional security information. Once you've imported a batch of transactions, you can work with them in numerous ways. For example, they need to be categorized correctly as income salary, freelance payment, and interest, for example and expenses food, mortgage, utilities, and so on.

The personal finance sites guess at what an appropriate category might be, but you can always change it—and you can split transactions between different classifications. If you're conscientious about this, you'll see charts that tell you where you're spending your money. This information can also be helpful when tax preparation time rolls around. Depending on which website you're using, you might be able to add tags to transactions. That way, you can search for those that are related in ways other than through their category assignments.

You can add notes and attach files, too. If you bought something with cash, your bank wouldn't have a record of it. In those circumstances, you can create a transaction manually. CountAbout goes a step further, providing an additional set of tools that let you make recurring transactions or flag them. Four of the five personal finance websites reviewed here have what's called a dashboard.

It's basically each site's home page, or the first screen you see when you log in. Sometimes, the dashboard is the only screen you'll need to see, because it displays the information you most need when you're checking on your financial situation. You'll learn what all of your account balances are and perhaps any bills that are pending. You'll see charts and graphs that tell you, for example, what your income is versus your spending, and how you're doing on your budget. You may be able to gauge your progress on any goals you've set and view your investment portfolio, with live prices if it's during the market day.

Basically, this overview shows you snippets of the detailed data that lies behind the numbers on this opening page. Click on a checking account balance in Mint, for example, and this link takes you to the account's register. Click on your credit score in Credit Karma, and you'll learn what contributes to it and how it's changed recently. So the dashboard on a personal finance website can either provide a quick look at your money situation or it can serve as a springboard to a deeper study of the numbers.

If you're a freelancer or sole proprietor, budgets can be challenging. You don't know for sure how much money you'll make in a given month like a W-2 employee does. Being conscientious about your finances includes trying to curb your spending so that it comes in below your income. Freelancers and sole proprietors might find that a small business accounting website is a better fit.

The best app for managing personal finances and budgets

The mechanics of creating a workable budget are much easier than the process of specifying your limits. Mint, for example, treats each category as a budget. You select one, choose a frequency for it every month, etc. The site shows you how well you're adhering to each budget by displaying a series of colored horizontal bars that show where your spending is currently compared with your budgeted amount. Green means you're doing OK, and red means you've gone over your self-imposed limit.

You can tweak each budget as you learn more about your spending habits by clicking up and down arrows. Other applications, like Quicken, consider a budget to be a comprehensive table that contains all categories. The software also lets you view your budgets by a variety of time periods monthly, annually, and so on. Setting goals, like trying to establish an emergency fund, isn't rocket science. You specify the amount you're trying to save and your target date for achieving it, and the application tells you how much you have to save every month to achieve it.

NerdWallet, for example, lets you link your goals to the appropriate spending account so your progress is automatically tracked. Quicken Deluxe includes additional planning tools that help you accelerate debt reduction, plan for taxes, and establish a comprehensive lifetime financial plan.

How We Chose the Best Personal Finance Software Programs

None of the sites we reviewed offer bill-paying tools, but some let you at least record bills and bill payments, because those can figure into your personal finance picture so significantly. Mint is especially good at this. You can set up a connection to online billers or enter offline bills automatically.

The site alerts you when they're due to be paid and lets you record payments manually if they don't get downloaded as cleared transactions from your bank. An excellent credit score is gold. Beyond helping you get approved for a credit card, mortgage, car loan, etc. So it's important to know not only what it is at any given time, but also to understand how it gets calculated and what you can do to improve it.

Credit Karma and NerdWallet, both free websites, can meet all of these critical needs.

- The Best Personal Finance Software for | agfox.com.

- The Best Personal Finance Services for 12222?

- The best free personal finance software | TechRadar.

- play wmv on mac quicktime?

- Best personal finance software for money management & budgeting - Mac & Windows.

- What people are saying about our personal finance software?

- airdrop mac to iphone ios 7.

Credit Karma is especially comprehensive and efficient here. It pulls your score regularly from two of the three major bureaus, and gives you access to your credit reports. One of the ways you can improve your credit score is to use financial products—credit cards, mortgages—that have attractive interest rates and other benefits, making it easier for you to pay off debt as quickly as possible. The three free websites we reviewed Mint, Credit Karma, and NerdWallet help pay for the services they provide by displaying ads for products that might appeal to you based on your credit profile. You can also browse marketplaces for additional candidates.

Of course, frequently cancelling credit cards to get new, different ones can affect your credit score. Still, it's good to learn about these suggested products so that when the time comes, you'll know what the best options are. You may only want to use a personal finance site for day-to-day income- and expense-management, budgeting, and goal setting.

But financial sites like Quicken and Mint let you track all of your assets, including homes, vehicles, and investment holdings. If you keep your financial data updated, the applications keep a running tally that, when combined with your debt, give you your total net worth.

You probably don't need advanced tools when you're away from your computer or laptop. But when you're out spending money, it's good to know how much you have. All of the solutions we reviewed offer both Android apps and iOS apps. They don't have all of the features found on the browser-based or software versions, but you can at least check your account balances, view and add transactions, and see graphs illustrating numbers related to things like spending and cash flow.

You may also be able to get your credit score and check the status of pending bills. Are all of the applications reviewed easy to use? The short answer is yes. Credit Karma and Mint are the most user-friendly, incorporating state-of-the-art interfaces with can't-miss navigation tools. CountAbout is certainly easy enough to use, but its user interface looks outdated. And because Quicken has been around for so long and offers so much, its user experience is a little uneven.