Tax programs for mac 2011

It's important to note that, once you've sold shares using the average cost method, you generally have to continue using it for that fund. Shares with the highest purchase cost are redeemed first. If two or more lots have the same unit cost, the oldest are redeemed first. Shares purchased more than one year ago with the highest purchase cost are redeemed first. After the long-term shares are depleted, short-term shares are redeemed in order of the highest purchase cost. Shares purchased less than one year ago with the highest purchase cost are redeemed first.

After the short-term shares are depleted, long-term shares are redeemed in order of the highest purchase cost. Shares with the lowest purchase cost are redeemed first. Shares purchased more than one year ago with the lowest purchase cost are redeemed first. After the long-term shares are depleted, short-term shares are redeemed in order of the lowest purchase cost.

Shares purchased less than one year ago with the lowest purchase cost are redeemed first. After the short-term shares are depleted, long-term shares are redeemed in order of the lowest purchase cost. All sold lots are depleted first against any lots that were purchased that day. After all lots purchased that day are depleted, then the disposal method defaults back to FIFO. Lots are depleted in the following sequence:. Short-term lots sold at a loss High loss to low loss, or highest cost to lowest cost. Long-term lots sold at a loss High loss to low loss, or highest cost to lowest cost.

Long-term lots sold at a gain Low gain to high gain, or highest cost to lowest cost. Short-term lots sold at a gain Low gain to high gain, or highest cost to lowest cost. The tax rate is multiplied by the gross gain or loss to determine the tax liability. The tax liability divided by the quantity results in the tax per share. The lot with the lowest tax per share is depleted first. While we currently calculate all mutual fund gains and losses using the average cost method, you have a wider selection of methods for other securities. Tell us now. Using our portfolio tools on usaa.

This default choice applies to all non-mutual fund securities within a given account. Tell us by the settlement date. Even after you've set a default method, you aren't locked into using it. You'll have until the trade settlement date, generally two business days after the trade for individual stocks, to select another method.

Tax Forms and Information

Individual securities: Mutual funds: We'll calculate your gains and losses using the average cost method. If you own a option contract — a broad based stock index option where the underlying security is an index — the requirements are different from other option types. Unlike equity-based options, each option contract held by a taxpayer at the end of the year is treated as if it were sold for its fair market value or mark-to-market MTM on the last business day of the year, and gains or losses are treated as either short-term or long-term capital gains.

Beginning Dec. These transactions will appear in the options section of the summary of non-reported income where proceeds aren't reported to the IRS. A new opening position equivalent to the fair market value or MTM will be created on the first business day of the next year. Under the new federal regulations, financial institutions like USAA are responsible for accurately tracking and reporting cost basis for these stocks.

This includes adjustments due to mergers, stock splits and return of capital payments. When a financial institution is required to track the cost basis of an investment covered security and transfers that covered security to another firm, it must pass its cost basis data along.

However, firms are not required to share cost basis information when you move non-covered securities — other than merely identifying them as non-covered. Investors may only update cost basis information on noncovered securities. USAA is responsible for maintaining accurate cost basis records for covered securities. If the donor's basis is less than the value of the gift at the time the gift is made, you generally must use the donor's basis. If it isn't, you would use:. The fair market value on the date of the gift, if it's greater than the sales price.

You're considered to have neither a gain nor a loss if the sales proceeds are greater than the fair market value on the date of the gift and less than the gifter's basis. For more information, see IRS Publication We'll use the following methods unless you tell us otherwise:. Under the laws governing cost basis reporting, we generally must receive that information in writing from the representative of the estate.

While USAA is responsible for reporting gains and losses on covered securities to the IRS and to members using Form B, taxpayers should use the information from their B to complete a Schedule D and Form for their tax return. Prior to our conversion, cost basis accounting was on a real-time system. This system assigned each tax lot an individual time stamp based on time of execution. Post conversion, cost basis accounting became an overnight batch process, eliminating the time stamp for multiple trades entered for the same security on the same day.

The post conversion system can cause trades to be processed out of chronological order. For intraday trades in the same security, the post conversion Cost Basis system assigns an event ID to each tax lot. These event IDs can keep track of the order of trades. However, an event ID is assigned first to a trade that executes in a single lot, and second to a trade that executes in multiple lots based on the average price. For example, if a buy order for shares executes in two share lots, an event ID is assigned as if the trade executed in a single lot at the average of the two prices.

Thus, the event ID is not assigned at the time of the trade when the buy or sell is a partial execution. Average pricing on trade execution causes the event ID to be assigned after single execution lots. ADM account disposal method selects lots based on how the trades executed single lot execution versus multiple lot execution and not the time of execution.

A trade executed in one lot will be considered first. A trade executed in multiple lots will be considered second, but as a single lot with an average cost basis. Based on these details, the general hierarchy used by the post conversion Cost Basis system is to sequence trades in the following order:. The new sequence is applied regardless of which ADM is used.

This means that the actual timing of the trades is not considered when selecting lots for a trade. This will create a loss on a trade the member thought would produce a gain. The net result will be the same overall net gain but the second trade will result in a loss which could create a wash sale if the security is purchased again within 30 days.

A wash sale occurs when you sell an investment at a loss and repurchase a substantially identical investment within a day period that extends from 30 days before you realize your loss until 30 days after. Losses from wash sales are not deductible. Instead, the loss is added to the cost basis of the repurchased investment. Distributions are occasionally based on estimates. Occasionally, distributions from mutual funds or stocks may include a return of capital. They are not taxed unless they exceed your original cost basis because they are considered a portion of your original investment returned to you.

A real estate investment trust is a corporation or business trust combining the capital of many investors to own and, in most cases, operate income-producing real estate. REITs specialize in real estate and mortgages of various types. They are capital gains earned on the sale of securities including mutual fund shares held for 1 year or less. When a fund distributes its short-term capital gain earnings, these amounts will be distributed and reported to you as an ordinary dividend in Box 1a of Form DIV and will be taxable at ordinary income tax rates.

They are capital gains earned on the sale of securities including mutual fund shares held for more than 1 year. When a fund distributes its long-term capital gain earnings, these amounts will be distributed and reported to you in Box 2a on Form DIV. They are taxed at favorable tax rates. It is income earned by a fund from investments made outside the U. In some cases, a foreign jurisdiction may withhold tax from the income earned by the fund. In these cases, a shareholder's foreign source income is equal to the income distributed by the fund to the shareholder plus the shareholder's allocable share of any foreign tax withheld on this income.

Keep in mind that reclassifications are not a change in the total amount of the payout, but adjustments of payouts into subcategories like long-term capital gains or return of capital or a change in the tax year of the distribution.

We receive information about reclassifications as they become available and make as many adjustments as possible before your original tax forms are delivered. Some companies do not provide notification of any changes before we send your tax forms. If this is the case, we will issue you a corrected We will make re-classification adjustments, as they become available. You will receive a Schedule K-1 directly from the limited partnership in which you are invested. If you receive a Schedule K-1 that you feel contains errors, contact the Limited Partnership directly at the phone number listed on the Schedule K-1 to request a corrected form.

If you have shares in a USAA mutual fund that holds foreign securities, you may take a credit or deduction for foreign taxes that the funds paid. Box 1 on Form DIV reflects gross income before foreign taxes have been deducted. For more information please consult your tax advisor or contact the IRS. Yes, but without full and adequate consideration, there may be tax consequences, depending on who the annuity is changed to.

If the transfer of ownership to an ex-spouse is due to a divorce, the transfer must be completed within one year of the divorce to not be considered taxable. Upon the death of the annuitant, the ownership could possibly be changed to a spouse or a non-spouse beneficiary. Please consult your tax adviser for more details on ownership change options and restrictions. It depends on the type of trust as identified in your trust documents. Transfers of assets to an irrevocable trust, with an independent trustee are taxable and reportable on Form R. Transfers to a revocable or grantor trust, which acts as the agent of the same individual, are not taxable nor reportable.

The following are examples of common transactions that are reportable but not taxable:. The following are examples of common transactions that are reportable and potentially taxable:. Earnings in a full surrender of non-qualified annuity contract Earnings in partial distributions of non-qualified annuity contract Earnings in the full surrender of the cash value on a life insurance contract Earnings in the partial distributions of the cash value of a life insurance contract Conversion of retirement plan assets to a Roth IRA Earnings on surrender of Paid Up Additions PUAs on Life Insurance contract Note: IRA owner may elect out of withholding.

Substantially equal periodic payments at least annually made for life or life expectancy Or, for a specified period of 10 years or more required minimum distributions. Non-qualified annuities: Policyholders can elect out of withholding. Payments made to a beneficiary of a deceased payee are subject to the same withholding rules. If you reside in certain states, we are required to withhold state income tax at the rate determined by your state when you have federal income tax withheld.

Also note that, for residents of certain states, a choice not to have federal income tax withheld constitutes the choice for not withholding of state income tax. Please consult your tax adviser regarding your specific situation and for additional state withholding requirements. It is when an individual moves from one contract to another contract without constructive receipt of the money. Section of the Internal Revenue Code provides that no gain or loss is recognized on the exchange of:. A contract of life insurance for another contract of life insurance or for an endowment or annuity contract.

A exchange doesn't allow for the exchange of an annuity contract for a life contract. A contract of endowment insurance either for another contract of endowment insurance that provides for regular payments beginning at a date not later than the date payments would have begun under the contract exchanged, or for a non-qualified annuity contract. A non-qualified annuity contract for a non-qualified annuity contract.

Tax information is required to be provided to most states and the District of Columbia. We participate in the combined federal and state tax filing with the IRS, which in turn forwards this information to the following states:. When required, we also file directly to the following states and territories:. Investing in securities products involves risk, including possible loss of principal. Prices for online products are determined at the time of print or e-file and may change without notice.

You should read its privacy and security policies. Intuit Inc.

USAA cannot guarantee that the information and content supplied is accurate, complete, or timely, and does not make any warranties with regard to the results obtained by its use. USAA and its affiliates do not provide tax advice. Taxpayers should seek advice based upon their own particular circumstances from an independent tax advisor. Restrictions apply and are subject to change. Skip to Content. Products View All Products. Health Insurance Dental Vision Medicare.

Advice View All Advice Center. Your Retirement Start a Plan. Advice Libraries Articles Infographics. Join USAA. Search Search: What can we help you find today? Clear Search.

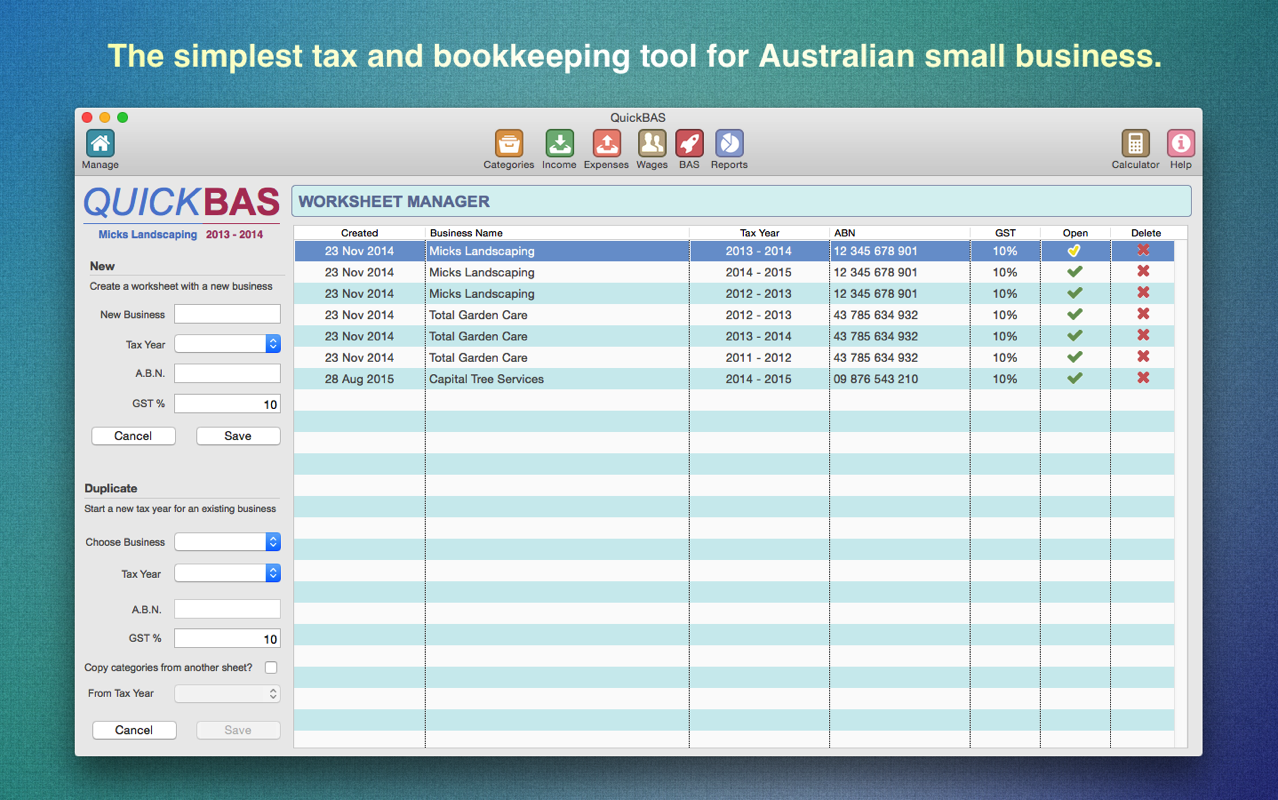

TaxTron Individual License for Macintosh

Security Center. Start of Content. Tax Forms and Information Find information about all your tax documents and other useful resources below.

Save with an ira Including an IRA in your tax strategy may provide potential savings when filing your taxes. Maximize Your Tax Refund Let us help you reach your financial goals and get the most out of your tax refund. Savings Account Use your tax refund to get started, and then consider an automatic deposit that goes directly into your account. Savings Booster Quickly boost your savings by automatically moving all or some of your tax refund into your savings account. Debt Manager Using your tax refund may help you pay off debt faster and save you money on interest.

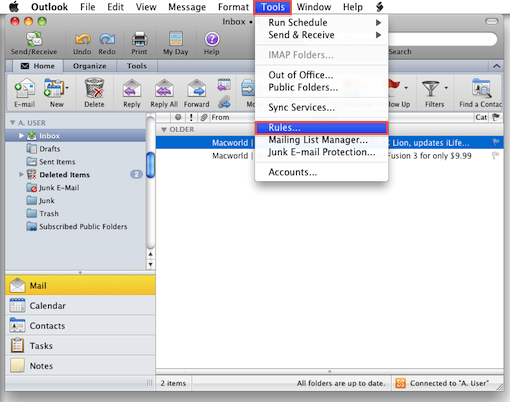

Understanding Investments Creating an investment strategy may help you grow your tax refund. Get Import Code. TurboTax Discount Expand All. Please be prepared with the following information: There used to be a discount on the TurboTax State product as well. Why is that now full price? When will my tax information be available for download with TurboTax on usaa. What tax form data is available for import into TurboTax? The following data is available: Why am I not able to import my checking and investment account interest into TurboTax? Why am I getting the error messages "no tax data available" or "tax information not available" when trying to download tax information into TurboTax?

Below are possible causes and solutions to help you download your tax information: What is the cutoff date for downloading into TurboTax? System Requirements Expand All. What are the system requirements for running TurboTax online? Minimum Operating Systems and Browsers: High-speed connection Minimum Operating Systems and Browsers: Didn't find what you were looking for?

Importing and Downloading. How do I get my tax form import code? Can I choose my own import code? Can I get an import code using my mobile device or tablet? What if my USAA tax form import code doesn't work? What types of accounts do not have a Tax Form Import Code? The following account types are not eligible for an import code, therefore tax information must be manually entered in to TurboTax: Version Now requires OS X Similar Software. No similar apps have been recommended yet. You can add your suggestions to the right. App Name. Smile Score. Suggest other similar software suggested.

Current Version Downloads 17, Version Downloads License Commercial.

JUDGE MAC DAVIS TAX PROGRAMS AND OTHER EXCEL CHILD SUPPORT MARITAL PROPERTY SPREADSHEET LINKS

Apple website , developer website. All the calculations can be saved, and it can be used for an unlimited number of employees and lots of different scenarios. At only 69 pence, can you afford to be without it? Work out essential items such as net wages, income tax, national insurance, pension, and any tax free allowances and deductions.

There is a multitude of options to cross-check the values before you finally submit them. The information presented can be used to modify various standard US tax forms, such as the W-4 withholding tax form, or the ES estimated tax form. Taxsoft includes every single form that you might need to prepare an American tax return — such as forms W-2, R, , , , and dozens more. The developers claim that you can prepare your entire tax return in about 30 minutes using the built-in tools.

- civ 3 free download mac.

- mac adresse windows 7 auslesen.

- Prior tax years for UFile.

- connect galaxy s5 to mac.

The software asks a series of basic questions complete with detailed but easily understood explanations about how to answer them, and you can print a paper version of the IRS forms with all the answers filled in the correct place. The application validates all your figures, making it one of the easiest ways to prepare a US tax return.