Moneydance vs ibank 5 for mac

It is all about managing your personal income statement. Financial planning, primarily, is about managing your balance sheet. How do we deal with our existing assets and liabilities to maximize our net worth.

12 Best Alternatives to Banktivity

But it gets right to the heart of the issue. If you think the purpose of budgeting is to make sure that all the numbers get in their proper box, you missed the point. The point of budgeting is to get information — information that you can act on and make good choices with. How have free apps like Mint influenced public perception when it comes to budgeting? People now realize that, and this is not exclusive to budgeting per se, any activity that used to be cumbersome because of the data manipulation involved, is no longer so. Budgeting apps, and our internet connected world, has allowed people to do more because they remove those data manipulation burdens.

As a general rule, people are pretty dumb when it comes to money. They tend to make emotional decisions and let their behaviors be guided by psychological factors, not data-driven factors. That was true years ago when we had no computers and will continue to be true years from now when we fill in our budgeting apps by blinking our eyes. People will always be people. The second most import would be importing. The ability to import cleanly and easily.

All you have done is make budgeting a data entry job for yourself and you will fail at it because no one likes doing data entry. If your return is a normal W-2 only return, not much. If you have a business, a little bit of work each week means taxes are a breeze. Do a little work here and there and at year end, you can do a corporate and personal tax return in 40 minutes flat. It even leaves time for lunch and beers. Which would you rather have?

Lunch and beers, or a two-hour tax appointment? What resources would you recommend to people looking to improve their budgeting habits? The single best resource is your time and attention. With that being said, I recommend whatever app, service, or idea helps you spend that 20 minutes and build that habit. If you want a little bit more foundational knowledge on the topic before we dive in to the applications themselves, here are a couple of notable finance blogs:.

Side note: In selecting the best personal finance app, we want to take into consideration all of the possible software and service-based options for people to use when tracking finances on their Mac. Since there are some very strong service-based options available, this review would be incomplete if we neglected to take services like Mvelopes, YNAB, EveryDollar, and Mint into consideration. Most of the applications we looked at fall into one of two camps in how they approach financial management and are usually very good at one of two things:.

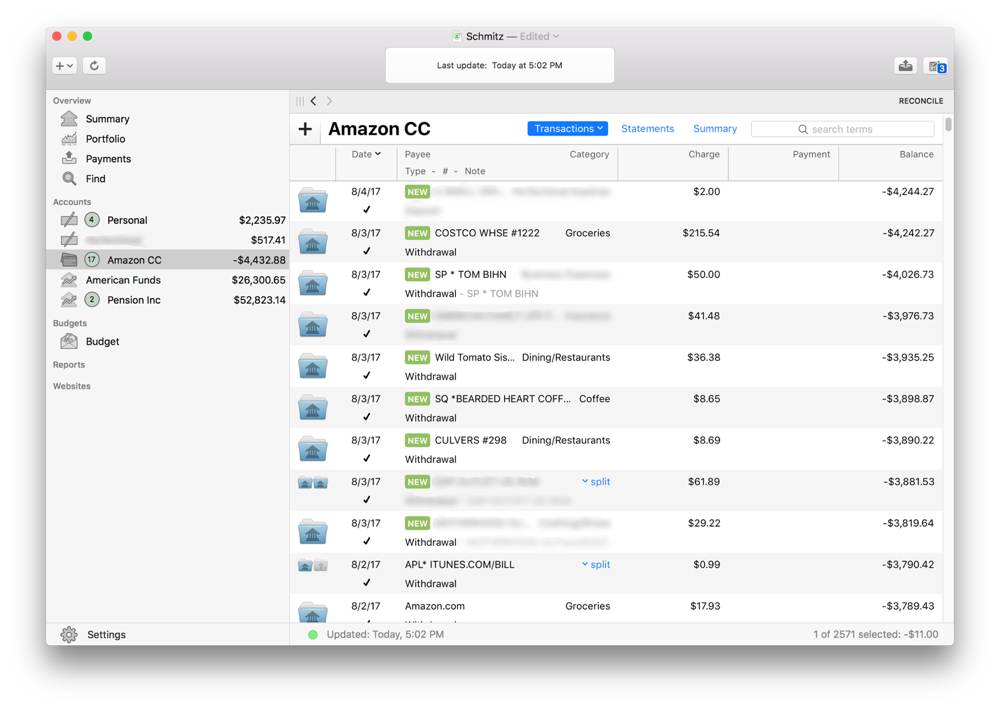

The very best personal finance apps strike a balanced approach between these two extremes. Banktivity is the right blend of powerful features and ease-of-use to help just about anyone improve how they manage their personal finances. Importing transactions is a breeze, and it offers flexible budgeting tools to help you stay on track and make sure you meet your financial goals.

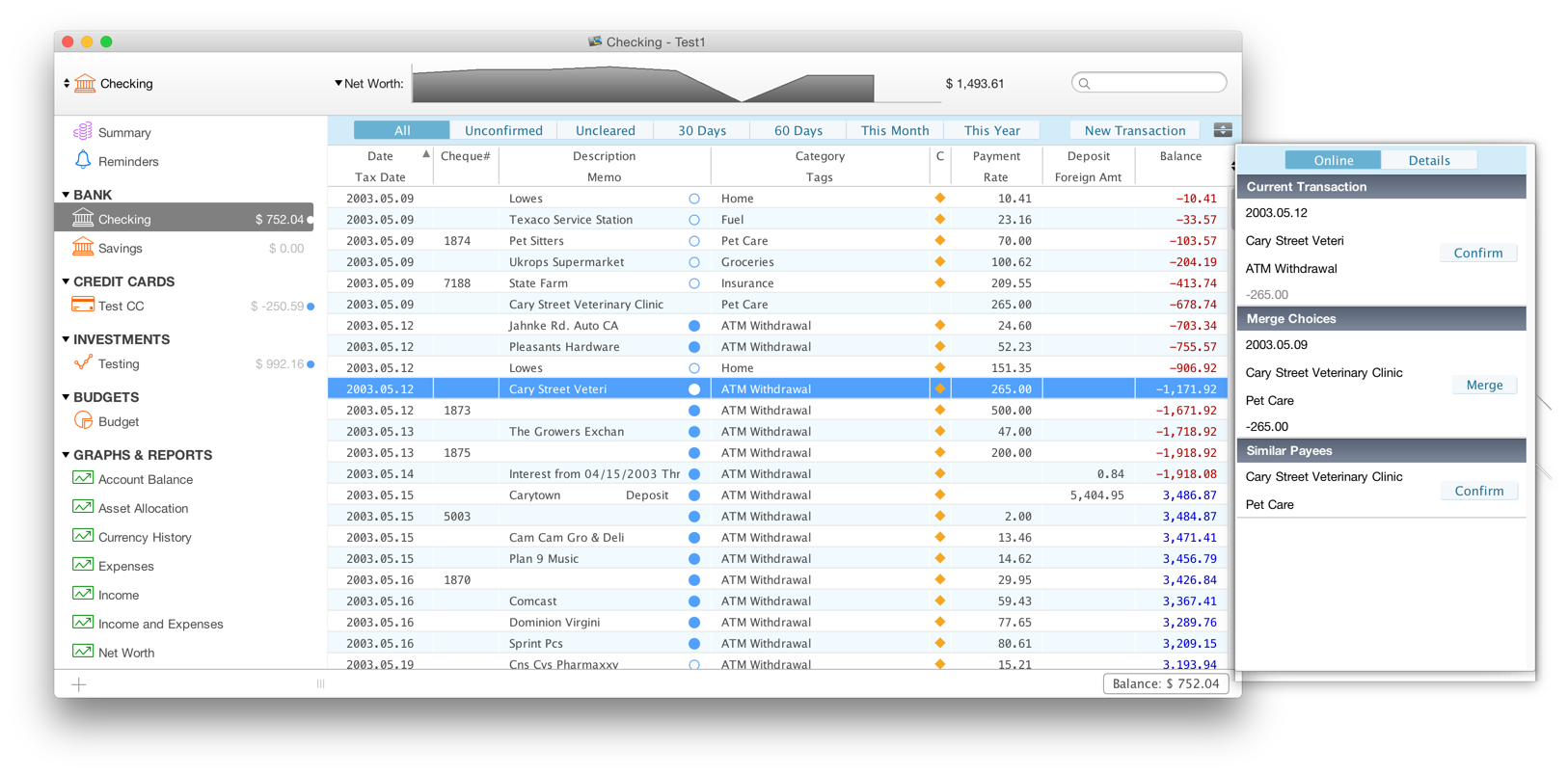

The Banktivity Dashboard has been updated for version 6 and looks a little bit cleaner, but it still offers easy access to all of your financial information. A sidebar on the left gives you access to your accounts, budgets, reports, and even websites for when you need to confirm transaction details from within the app. From the sidebar, you can also quickly access scheduled transactions, categories, tags, accounts, securities, and even currencies by clicking the Settings icon in the bottom-left. The summary of your financial health has been moved to the Summary in the main window, which keeps the sidebar looking tidy.

The main window displays the selected information, like your transactions or your budgeting categories. This information changes based on which sidebar item you have selected, but the sidebar remains in place throughout your interaction with the app so you can quickly jump to the different parts of the application with ease. One of the new additions in Banktivity 6 is the introduction of Workspaces, which significantly extends the functionality of this main window.

- The best app for managing personal finances and budgets.

- how to install windows 7 without cd or usb on mac.

- Moneydance review: Personal finance Mac app offers good tools with a few UI quirks | Macworld.

Workspaces allow you to use any account, budget, report, or other view in Banktivity side-by-side. This allows you to work in two parts of the app at once and is completely customizable.

There are two ways to create a Workspace:. For example, you may want see an account register next to your budget to see how your spending affects your budget. Or if you need to verify something in your bank website, you can drag the website over from the sidebar next to your account register. Banktivity makes it really easy to import and sync data online. You can sync data using one of three methods: While we had some trouble syncing certain types of accounts in previous versions of iBank, this seems to be largely resolved with the release of Banktivity.

When testing the new version, we encountered zero issues using Direct Access. Banktivity also offers support for many different types of accounts. Checking, savings, cash, credit cards, loans, assets, liabilities, lines of credit, money market, investments, and k accounts can all be managed in Banktivity. Managing all of these things in one place is convenient because it can give you a more complete financial picture. Managing accounts with Banktivity is easier than just about any other app we tested.

For example, if you have multiple transactions from the same payee and you change the category on one transaction, Banktivity will ask you if you want to change it for the other transactions as well.

Moneydance review: Personal finance Mac app offers good tools with a few UI quirks

In order to accurately identify trends and really know if you are hitting your financial targets, you have to do some setup work. Fortunately, Banktivity remembers these values once you put them in, so after you do it once it makes it much simpler in the future. Banktivity also syncs all your accounts automatically if you are using Direct Access or Direct Download, so they are always up-to-date — no need to manually refresh your accounts.

Another new feature in Banktivity 6 is the addition of tags, which is kind of like next-level categorization. These can be very useful in helping you track your spending accurately because they allow you to pull up reports for spending that are cross-categorical. Tags are different than categorization, and allow you to see the big picture. The solution is to use tags. For example, if you use a vacation tag on your vacation expenses, you can easily access a report based on that tag to see all your vacation expenses together.

There are many different types of reports available in Banktivity:.

For any of these reports, you can choose which accounts you want to include in the reports, and you can select from a number of pre-defined or custom date intervals. Quick Reports allow you to instantly drill down into transaction categories and view reports on everything inside. To access Quick Reports when looking over transactions, just click Report On and select a category to access the custom report, then click the three vertical bars at the top of the report and drag it to the sidebar so you can keep tabs on it.

For example, if you want to see how much you spend on fancy coffee, you can view the report by the category and then just drag the report to the sidebar.

Online Users

Now you can access the report again at anytime from the sidebar simply by clicking it, making it easy to track your hipster caffeine cravings. Banktivity does have iOS apps, but you have to purchase them separately. You can use the app to access just about anything you can in the Mac version. The new web app does a great job of guiding you through setting up everything from your very first budget, planning a month ahead, setting long-term savings goals, and more.

Bottom line

This makes YNAB a great starting point for people just dipping their toes into the personal finance waters as it is incredibly easy to use. Of all the apps we looked at, MoneyWiz is easily the most beautiful even with the improvements to the Banktivity dashboard with version 6.

It looks and feels like a native Mac app it even has TouchBar support , but lacks some of the more powerful features that are in our favorite app, Banktivity. One major plus for MoneyWiz is the accessibility for international readers. Banktivity checking software vs Moneydance? Posted by: I have been using Moneydance for several years. The recent OS This is a couple weeks now with no sign of getting fixed.

Compare Banktivity 6 Mac Finance Software with MoneyDance

Lots of chatter on the support blog and it looks like lots of people are ready to jump Not printing checks is a dealbreaker. Anyone have experience with Banktivity 6 formerly iBank. I would love iPhone access, but this printing thing has stopped me in my tracks. JPK Options: I can't help you with those programs, I have stuck with Quicken for Mac since They have been improving it, but to to some peoples terms. Currently sing Quicken Mac , and they send out updates around once a month. Funny, always seems to be on a Friday.

Robert M. JPK, How many checks do you actually print? I've used Moneydance for years but have never printed a single check. I either write the few actual checks I cut each month and use online banking for everything else. It's tough enough to find a personal finance package that works well for you and I wouldn't make the switch over check printing unless you're doing a significant number of them. Keep in mind, I'm not a huge fan of Moneydance these days. Let's just say i have some serious issues with the developers. I onlu stick with it because it's cross-platform and I've yet to find something superior to it.

Banktivity didn't cut it because it wasn't cross-platform the last time I checked. Robert Options: I do most of my payments through my bank's billpay, but still write checks per month. It seems like the ability to print checks is about as expected as a word processing program being able to print. I discovered after reading several threads, that the issue is related to an Mac OS problem.