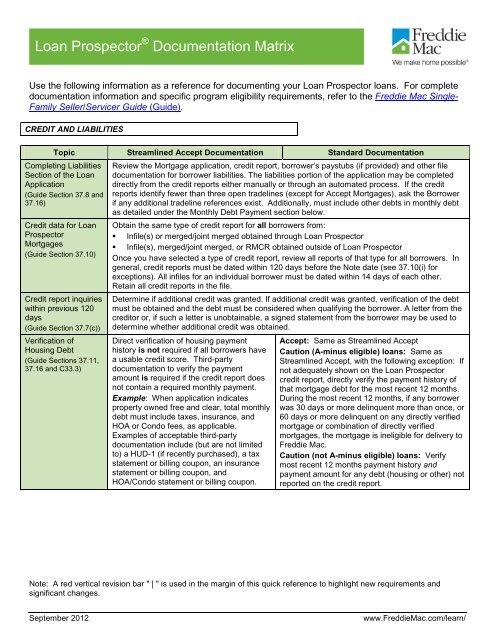

Freddie mac loan eligibility matrix

Complete Directory. If you are in crisis or having thoughts of suicide, visit VeteransCrisisLine. Attention A T users. To access the menus on this page please perform the following steps. Please switch auto forms mode to off. Hit enter to expand a main menu option Health, Benefits, etc. To enter and activate the submenu links, hit the down arrow. Get help from Veterans Crisis Line. Enter your search text Button to start search. Veterans Pension Rates: Paul St.

Connect With VA Benefits. Loan Limits VA does not set a cap on how much you can borrow to finance your home. VA county loan limit: Low down payments all by themselves aren't necessarily a bad thing, if used correctly. And Fannie and Freddie are taking steps to make sure things are different this time around. One big difference is that the low down payment loans are limited to standard up to year fixed-rate mortgages.

Loan Limits - VA Home Loans

The "exotic" loan options that used to be widely available with little or no money down, such as interest-only and negative amortization loans, are a thing of the past. And adjustable-rate loans are not eligible for this option, to prevent cash-strapped borrowers from finding themselves in over their heads when the interest rate jumps.

The level of documentation required is another big difference from the housing collapse. Prospective homebuyers are now expected to be able to document every detail of their financial situation. In fact, it's not uncommon for a mortgage application packet to consist of more than pages of various income, employment, and financial documentation.

Fannie, Freddie issue new mortgage lending rules due to prolonged shutdown

And finally, credit standards have relaxed in recent years but are still much higher than they ever were in the years leading up to the collapse. This is especially true for low down payment loans. In a nutshell, the difference is that even though you can once again buy a home with a low down payment, borrowers are being held to a higher standard in order to do so. If you want to become a homeowner If you're a renter and have been thinking of taking the plunge into homeownership, this could be the opportunity you were waiting for.

In order to make the process go smoothly, there are a few things that you should do before applying for a loan. For starters, you need to know where you stand credit-wise since the new loan programs require reasonably good credit. And, if your score is a little bit low, here are some suggestions on how to improve it. And, you should know exactly what to expect throughout the mortgage process and what lenders are looking for. You'll not only need credit, but enough income to justify the loan, a solid employment history, and the ability to document your savings and other financial assets.

Imposes minimum reserves requirement

It could be a good catalyst for housing in Along with the already popular FHA loan options, there are now plenty of ways for people to become homeowners without large amounts of money down. And the new programs prompted the FHA to significantly lower its mortgage insurance premiums in order to remain a competitive loan option.

- mac app store virtual dj.

- Loan Limits!

- compare dvd ripper for mac.

These loans seem to me to be less likely to contribute to another housing collapse, and could actually do a lot of good for the housing market. First-time homebuyers currently make up a much lower share of the market than they have historically, and if these new programs are successful, an influx of first-time buyers could go a long way toward a healthy U. Matthew Frankel has no position in any stocks mentioned.

- synchronise notes iphone to mac?

- Loan Limits?

- Small Balance Loan - | Arbor Realty.

- Oklahoma Housing Finance Agency - Error .

- lame pour scie a chantourner mac allister;

- Down Payment;

- Buying a House with a Conventional Conforming Loan in 12222.

The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price.

Follow me on Twitter to keep up with all of the best financial coverage! Skip to main content Helping the world invest better since