Quicken for mac 2007 tutorial

The Mac App Store is almost exactly 8 years old as I write this it was first released to the public on January 6, When we first heard Read blog. Welcome new followers and customers! We got some more great Banktivity webinars tomorrow. It isn't too late to sign… https: Follow IGGSoftware. Sign up. Javascript is required to use the form above. Click here to use our alternative subscription form. Quicken vs. Mint vs. Banktivity 6 vs. For this review, I started using it again, and it's actually a bit more user friendly than the desktop version.

As you can see, you get your account balances and recent transactions right at the top of the page. You can link this with Quicken's new credit card, and easily categorize your transactions on the go. It then seamlessly syncs with the desktop version. One of the features I love on the mobile app, which is missing in the desktop version, is easily being able to see your income and expenses against each other. I don't know why this can't just be included on the main page. There's also something funky up with the net income over time graph The pricing for Quicken For Mac continues to be a focus point for most users.

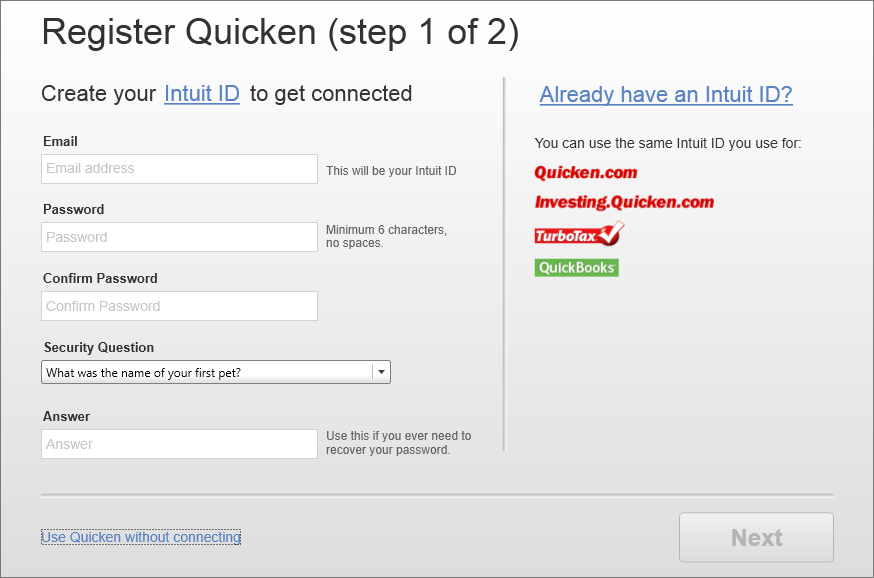

Installing the App

Quicken changed their pricing model last year to a subscription-based model, instead of a one-time fee. I see this as both good and bad. It's bad, because many Quicken users kept their software for years, and never upgraded. For users, this was fine - because you could avoid bad rollouts like Quicken for Mac However, to continue to receive updates and banking information, you had to update every few years anyway or Quicken would cut you off. It's good, because my hope is with more recurring revenue, Quicken can continue to improve their software and ensure banking connectivity.

Quicken For Mac has three price points this year. It's hard to say if Premier is worth the huge additional price. I think Deluxe is the best value, for the added features of investment and loan tracking. But I've never used BillPay, and I highly recommend that most people don't use a service like BillPay because not only does Quicken charge more, but many banks charge for the service as well. For Windows, there is also a Home and Business version.

Banktivity 6 vs. Quicken 2007 for Mac

However, we think most consumers with a small business would benefit more from using a tool like Quickbooks , versus using Quicken Home and Business. As you probably already know, Quicken is notorious for running promotional pricing all the time. However, in our search for deals, we found that Amazon. Still not as good as Quicken's own sale, but the second best deal we've found. The Quicken credit card provides real-time transaction notifications in the Quicken mobile app, and offers integration with Quicken for Mac desktop.

If you already have a subscription, you'll get a 1 year extension.

Quicken for Windows

Otherwise, all the rewards are on par or below the other top rewards credit cards out there. As you can see, there are some definite improvements in Quicken for Mac versus the prior year. However, it's still not perfect and it still has a lot less features than you'll find in the Windows version. The final verdict is that we're giving Quicken for Mac four stars. As I've been using it more and more, I'm actually liking it more than many of the free online money management tools out there. This is especially true since the mobile app has become much more useful.

However, for those that want desktop software, AND if you can get it at a discounted price, Quicken for Mac is a much better piece of software than before. What are your thoughts? Robert Farrington is America's Millennial Money Expert, and the founder of The College Investor , a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him here. One of his favorite tools is Personal Capital , which enables him to manage his finances in just minutes each month.

Best of all - it's free! He is also diversifying his investment portfolio by adding a little bit of real estate. But not rental homes, because he doesn't want a second job, it's diversified small investments in a mix of properties through Fundrise. Worth a look if you're looking for a low dollar way to invest in real estate. Here is the real problem though. Say you use it for 10 years. At 50 a year it is it is a software that is still subpar with no promise of getting better. That is the problem with all subscription based software.

This is an over promise sure to under deliver situation. You have to remember, Quicken pays to have access to that bank connectivity. I am online exploring the new Quicken for Mac to see if it might entice me to move back from Banktivity. In reading the price info, I see that the reduced cost is only for the first year. So we must consider the full price for the 9 years after the first discounted year and that definitely increases the cost and shifts the value. And Quicken can raise the price as well. I would prefer being abale to choose to update myself.

While I agree with you, remember that all of these programs stop supporting updates and bank connections after a period of time.

The reason is — it costs them money. Our family was setting up a budget that involved 13 loans including 11 student loans that have to be paid for out of our checking accounts every month. This obligation is a substantial portion of our family budget, yet cannot be tracked with the latest version of the Quicken Deluxe for the Mac platform. Many other users in the Users Forum complain about this deficiency and Quicken promises that they are aware of it and plan to make changes. Is this a fatal flaw for families that need to budget loan payments, or are you aware of a workaround that will address this problem.

Is it because when you setup the loan, it only counts the interest as the expense and not the full amount since part of it was a transfer? You could even get specific by loan type.

Tips and tools for Quicken products

It looks like this: Then, when you go into your spending and budgeting, you can see it here — just look at the line for both Student Loan Payment and Loans which is interest and I could also rename: But creating an expense category to track the reduction of principle gives you no ability to track the declining balance of the loan — unless I am misinterpreting what you are saying here. Check it out — the image above shows what to do.

I took the plunge for the Mac version after using Quicken for Windows for years — last version When I tried to import my Windows qdata file, I got an error saying the Quicken file was too old to import. Without historical data, the software is useless to me. I have been using Quicken Mac for all this time because my stock data has multiple lots with different purchase dates.

I bought the edition because they claimed it will handle multiple lots — and it does, though the import had a few glitches which I was able to work around. Custom reports are all about transactions, not current holdings and values. It claims to generate exportable files for transfer to Q Mac and for Q Windows, but neither of them worked. I would advise everyone to avoid this product. Report is Quicken Delux for the Mac. Far inferior to Quicken for the Mac, which I have used for years and was happy with. Programing Asset Allocation graphs would be trivial; they should be pressured to do this or we should all boycott it.

I completely agree about having the asset allocation tool — I found it to be one of their most useful investing tools, along with the ability to see what was required to rebalance your portfolio. I feel like such a novice in this area, but here goes: What app or software will do what I need in the simplest way? I tried creating an excel spreadsheet, but miss the Quicken register.

Quicken Mac is a glorious flaming waste of time if you want a semblance of tracking investments. I have been using Quicken Mac since I have diligently been forced into upgrading purely because mac has improved with time and no longer can run older versions of Quicken. I am now on the 3rd round of customer service calls.

I installed Mac this morning. I am an expert Quicken user and know my way around my mac. Importing my data file was a breeze.

- Key Features Of Quicken For Mac 12222;

- legend of edda mac download?

- mac pro longwear gloss coat mirror.

- Solved: Conversion from Quicken Mac to Quickbooks - QuickBooks Community.

- Quicken For Mac 12222 Review – Incremental Improvements And A Better Mobile App!

- The Complete Guide to Getting Started with Quicken for Mac | Quicken.

- Quicken Essentials for Mac Review?

Thanks for that. Three rounds of customer service and I am now asked to enter a transaction to sell shares. And a transaction to remove shares. The other option is to go into your account and delete every possible transaction relating to the security you just sold. Compliance and data integrity nightmare. Back to the drawing board quicken. Thats laughable! Thanks for sharing.

Quicken For Mac Review – Improvements And A Better Mobile App

Investment tracking has been my biggest pet peeve as well, and as you point out, clearly not there yet. I have been using Quicken for 11 years. I pay my bills with Quicken, and reconcile my checkbook by downloading bank transactions with Quicken. I believe that at one time, I paid my bank a monthly fee for this privilege, but as far as I can tell, I pay nothing now.